-

Posts

95 -

Joined

-

Last visited

-

Days Won

5

Content Type

Forums

AutoShopOwner Articles

Downloads

Blogs

Gallery

Profiles

Events

Store

Links Directory

Shop Labor Rates

Community Map

Everything posted by nptrb

-

The Inflation Reduction Act of 2022 was signed into law with the goal of addressing economic challenges and encouraging businesses and homeowners to adopt more “green” energy practices. With this bill comes an important provision: the Home Energy Efficient Tax Credit. This credit incentivizes homeowners to make energy-efficient improvements to their homes. In this blog post, we’ll explore how the Home Energy Efficient Tax Credit works, who can qualify, what potential amounts and expenses there are, and how you can apply to claim this tax credit. What is the Home Energy Efficient Tax Credit Under the Inflation Reduction Act of 2022? The Home Energy Efficient Tax Credit is a financial incentive provided to homeowners under the Inflation Reduction Act of 2022. This credit gives homeowners the opportunity to receive tax credits when they invest in energy-efficient home improvements, such as solar or wind energy, energy efficient heating and cooling, etc. These improvements aim to make homes more sustainable and “green,” reducing energy consumption and the costs associated with it. Who Can Qualify for the Home Energy Efficient Tax Credit? In order to qualify for the Home Energy Efficient Tax Credit, there are certain criteria that homeowners must meet. For the most part, if individuals make eligible energy-efficient improvements to their primary residence, they will qualify. Renters and those that make improvements to a second home used as a residence may also qualify. If you make improvements to a home that is never used as a residence, you will not qualify. It’s important to note that you can ONLY claim the credits for the year in which the improvements were installed. What Are the Qualifying Credit Amounts and Expenses? The qualifying credit amounts and eligible energy-efficient expenses are directly related to the type of improvement made. For home clean electric products, such as solar electricity, fuel cells, wind turbines, and battery storage, the tax credit is 30% of the cost. For heating, cooling, and water heating, such as heat pumps, heat pump water heaters, solar water heating, efficient air conditioners and heating equipment, etc, the tax credit is anywhere from 30% of the cost up to a maximum of $600 or $2,000 (depending on the improvement). Other energy efficient improvements may also qualify for at least 30% of the cost such as insulation materials, exterior doors, windows, and skylights, home electric vehicle chargers, etc. As a homeowner, be sure to carefully review the legislation and rules surrounding these improvements and tax credits in order to maximize your financial benefits with the Home Energy Efficient Tax Credit. You can learn more on the specifics, qualifying improvements, percentages, and limits on the energy.gov website. How Do You Claim the Home Energy Efficient Tax Credit? In order to claim the Home Energy Efficient Tax Credit, there is a process you must follow. DOCUMENT YOUR IMPROVEMENTS You must keep a detailed record as proof of the energy-efficient improvements made to your home and residence. Keep all relevant documents, such as quotes, receipts, and invoices. ENSURE ELIGIBILITY Make sure to double check that the energy efficient improvements made quality for the tax credit. Again, check the specific requirements and tax credit amounts and expenses to ensure you are eligible. COMPLETE THE NECESSARY FORMS ALONG WITH DOCUMENTATION In order to apply for and claim this tax credit, you must file Form 5695, Residential Energy Efficient Tax Credits Part II with your tax return. You must claim the credit in the tax year that the improvement was installed (not purchased). Be sure to consult your tax professional to ensure the forms have not changed. Attach the necessary documents (quotes, receipts, and invoices) to your form when submitted. This is a key step for ensuring the expenses associated with the improvements are considered and matched up with the potential available credit. In conclusion, the Home Energy Efficient Tax Credit under the Inflation Reduction Act of 2022 is a great opportunity for homeowners to make energy efficient improvements while being rewarded with financial and tax-saving incentives.

-

Tax season is just around the corner, and for many, this time of year can be both daunting and overwhelming. However, with the proper planning and organization, you can take on tax season with confidence! This blog post will serve as your comprehensive guide to tax season preparation, outlining the key steps you need to take to ensure a smooth and stress-free tax season! How To Prepare For Tax Season Preparing for tax season seems like a year-long process at times. From tracking mileage to organizing receipts, there’s always something tax-related to do. However, when the calendar turns over to a new year, it’s time to really start thinking about tax season preparation and the steps you need to take to get ready for filing day. Read on for your complete guide to tax preparation and everything you need to know! STAY INFORMED ABOUT TAX LAW CHANGES Tax laws are ever-changing and it is your responsibility to stay informed on these changes, as they can make a significant difference. Familiarize yourself with any updates or changes to tax laws that may affect your filing status or eligibility for credits. You can also reach out to your tax preparer or accountant for more information on these changes and the potential impacts on your taxes. GATHER AND ORGANIZE KEY DOCUMENTS This is one of the most daunting parts of the tax season preparation process – gathering all of the key documents needed. This includes tax forms such as W-2’s, 1099s, and other forms. You’ll also want to gather and organize receipts, mileage records, social security documents, bank statements, income statements, expense records, payroll records, tax deduction records, profit and loss statements, balance sheets, financial statements, and any other relevant or requested paperwork. Take some time to review all of your financial documents and categorize them by income and expenses to make it easier to identify potential deductions or tax credits. You can use an accounting software like Quickbooks Online to make this process simple. Having all of the documents you need to properly file your taxes in one organized place will save you a lot of time and prevent last-minute searches. EXPLORE DEDUCTIONS AND CREDITS With all of your documents and records organized and in one place, you can explore and identify potential deductions and credits that are available to you. Some common deductions and credits include: Mortgage interest. Student loan interest. Medical expenses. Startup costs. Business expenses. Depreciation. Child Tax Credit. Education Credits. These deductions and credits can save you significant amounts of money, so do your due diligence and explore all of your options. CONSIDER PROFESSIONAL HELP While some individuals prefer to handle and file their taxes themselves, it is beneficial to seek out professional help. Tax professionals can provide advice and expertise, help ensure that you have everything you need, it’s all accurate, you are maximizing your savings, and overall, help you navigate tax season with a little more ease and peace of mind. PLAN FOR RETIREMENT CONTRIBUTIONS If you’re looking for more ways to positively reduce your tax liability (while planning for the future!), you can contribute to retirement accounts, such as 401(k)s or IRAs. Evaluate your contributions and look for ways to maximize them in order to take advantage of potential tax benefits, thus, reducing your tax bill. REVIEW BEFORE SUBMISSION Just like when you were in school getting ready to turn in a big test, it’s key to thoroughly review your tax return before submitting it. Check to make sure that all information is entered correctly, you’ve chosen the correct filing status, and all deductions and credits are accounted for. REFLECT AND PLAN FOR NEXT YEAR While you may be begging for a break from taxes once you’ve filed, this is a great time to reflect and plan for next year. Consider ways to make your life easier when it comes to next year’s tax season preparation as well as ways that you can maximize your tax savings. You may look at adjusting your withholdings, organizing your financial documents throughout the year using Quickbooks Online, tracking mileage using a software like TripLog, or managing your receipts online using Hubdoc or Dext. It’s never too early to stay proactive with your tax planning. By following these steps and guidelines for tax season preparation, you can stay on top of things, take advantage of resources and opportunities to save, and get through tax season with less stress and more confidence.

-

Tax season is just around the corner, and for many, this time of year can be both daunting and overwhelming. However, with the proper planning and organization, you can take on tax season with confidence! This blog post will serve as your comprehensive guide to tax season preparation, outlining the key steps you need to take to ensure a smooth and stress-free tax season! How To Prepare For Tax Season Preparing for tax season seems like a year-long process at times. From tracking mileage to organizing receipts, there’s always something tax-related to do. However, when the calendar turns over to a new year, it’s time to really start thinking about tax season preparation and the steps you need to take to get ready for filing day. Read on for your complete guide to tax preparation and everything you need to know! STAY INFORMED ABOUT TAX LAW CHANGES Tax laws are ever-changing and it is your responsibility to stay informed on these changes, as they can make a significant difference. Familiarize yourself with any updates or changes to tax laws that may affect your filing status or eligibility for credits. You can also reach out to your tax preparer or accountant for more information on these changes and the potential impacts on your taxes. GATHER AND ORGANIZE KEY DOCUMENTS This is one of the most daunting parts of the tax season preparation process – gathering all of the key documents needed. This includes tax forms such as W-2’s, 1099s, and other forms. You’ll also want to gather and organize receipts, mileage records, social security documents, bank statements, income statements, expense records, payroll records, tax deduction records, profit and loss statements, balance sheets, financial statements, and any other relevant or requested paperwork. Take some time to review all of your financial documents and categorize them by income and expenses to make it easier to identify potential deductions or tax credits. You can use an accounting software like Quickbooks Online to make this process simple. Having all of the documents you need to properly file your taxes in one organized place will save you a lot of time and prevent last-minute searches. EXPLORE DEDUCTIONS AND CREDITS With all of your documents and records organized and in one place, you can explore and identify potential deductions and credits that are available to you. Some common deductions and credits include: Mortgage interest. Student loan interest. Medical expenses. Startup costs. Business expenses. Depreciation. Child Tax Credit. Education Credits. These deductions and credits can save you significant amounts of money, so do your due diligence and explore all of your options. CONSIDER PROFESSIONAL HELP While some individuals prefer to handle and file their taxes themselves, it is beneficial to seek out professional help. Tax professionals can provide advice and expertise, help ensure that you have everything you need, it’s all accurate, you are maximizing your savings, and overall, help you navigate tax season with a little more ease and peace of mind. PLAN FOR RETIREMENT CONTRIBUTIONS If you’re looking for more ways to positively reduce your tax liability (while planning for the future!), you can contribute to retirement accounts, such as 401(k)s or IRAs. Evaluate your contributions and look for ways to maximize them in order to take advantage of potential tax benefits, thus, reducing your tax bill. REVIEW BEFORE SUBMISSION Just like when you were in school getting ready to turn in a big test, it’s key to thoroughly review your tax return before submitting it. Check to make sure that all information is entered correctly, you’ve chosen the correct filing status, and all deductions and credits are accounted for. REFLECT AND PLAN FOR NEXT YEAR While you may be begging for a break from taxes once you’ve filed, this is a great time to reflect and plan for next year. Consider ways to make your life easier when it comes to next year’s tax season preparation as well as ways that you can maximize your tax savings. You may look at adjusting your withholdings, organizing your financial documents throughout the year using Quickbooks Online, tracking mileage using a software like TripLog, or managing your receipts online using Hubdoc or Dext. It’s never too early to stay proactive with your tax planning. By following these steps and guidelines for tax season preparation, you can stay on top of things, take advantage of resources and opportunities to save, and get through tax season with less stress and more confidence. View full article

- 1 reply

-

- 1

-

-

Understanding and navigating the tax implications and responsibilities of business income is crucial for every business owner, especially those operating as an S-Corp. A very common question that often arises is whether or not S-Corp distributions and draws are taxable. In this blog post, we’ll answer this question and explore the key considerations of S-Corp taxation. What Are the Benefits of an S-Corp? First, it’s important to understand the benefits of operating a business as an S-Corp. S-Corps provide a unique level of flexibility with money, as there is a single-level of taxation on income generated by the corporation. This differs from C-Corps, in which profits are taxed at both the corporate and individual levels. In an S-Corp, income “passes through” to the shareholders, meaning it is subject to tax on the shareholder’s individual income tax return, not the business’s. Are S-Corp Distributions and Draws Taxable? Now, let’s answer the burning question of, are you going to be taxed on distributions and draws from an S-Corp? The short answer is… no! Generally, you are not taxed on distributions and draws, which is one of the most significant benefits that an S-Corp offers. However, the key to all of this is to pay yourself a fair and reasonable wage as an S-Corp shareholder. The IRS requires you to compensate yourself adequately, and once you have paid yourself a fair and reasonable wage, you are free to distribute or take the remaining profits out in draws. Avoiding Payroll Tax Pitfalls Keep in mind that as your profits increase, it’s not recommended to increase your payroll. Why? This leads to higher payroll taxes! However, S-Corp distributions are not subject to these payroll taxes, making this a better option for business owners looking to maximize their income without taking on additional tax burdens. Distinguishing Distributions from Profit Distributions are essentially the sharing of profits among shareholders. The benefit is, you don’t pay taxes on the distribution itself, just on the profit that it represents. This is key to remember when understanding the tax implications of S-Corp income. Before taking out distributions as an S-Corp, you must have actual profits to distribute. Therefore, business owners must track and manage their profits effectively in order to benefit from distributions come tax time. Avoiding Tax Issues When taking out S-Corp draws, ensure that you are taking out actual profits, not loan money, such as that from the SBA. This can have significant tax implications that can lead to complications and hassles down the road. Overall, S-Corp distributions and draws are not taxable. This makes S-Corps a great choice for small business owners looking to maximize their profits and save on taxes. Just make sure you stay up-to-date on the IRS guidelines, pay yourself a fair wage first, and ensure your distributions and draws are based on profits. This can help you make informed and smart financial decisions that benefits both you and your business long-term. View full article

-

Understanding S-Corp Distributions and Draws | Are They Taxable?

nptrb posted a article in Automotive Industry

Understanding and navigating the tax implications and responsibilities of business income is crucial for every business owner, especially those operating as an S-Corp. A very common question that often arises is whether or not S-Corp distributions and draws are taxable. In this blog post, we’ll answer this question and explore the key considerations of S-Corp taxation. What Are the Benefits of an S-Corp? First, it’s important to understand the benefits of operating a business as an S-Corp. S-Corps provide a unique level of flexibility with money, as there is a single-level of taxation on income generated by the corporation. This differs from C-Corps, in which profits are taxed at both the corporate and individual levels. In an S-Corp, income “passes through” to the shareholders, meaning it is subject to tax on the shareholder’s individual income tax return, not the business’s. Are S-Corp Distributions and Draws Taxable? Now, let’s answer the burning question of, are you going to be taxed on distributions and draws from an S-Corp? The short answer is… no! Generally, you are not taxed on distributions and draws, which is one of the most significant benefits that an S-Corp offers. However, the key to all of this is to pay yourself a fair and reasonable wage as an S-Corp shareholder. The IRS requires you to compensate yourself adequately, and once you have paid yourself a fair and reasonable wage, you are free to distribute or take the remaining profits out in draws. Avoiding Payroll Tax Pitfalls Keep in mind that as your profits increase, it’s not recommended to increase your payroll. Why? This leads to higher payroll taxes! However, S-Corp distributions are not subject to these payroll taxes, making this a better option for business owners looking to maximize their income without taking on additional tax burdens. Distinguishing Distributions from Profit Distributions are essentially the sharing of profits among shareholders. The benefit is, you don’t pay taxes on the distribution itself, just on the profit that it represents. This is key to remember when understanding the tax implications of S-Corp income. Before taking out distributions as an S-Corp, you must have actual profits to distribute. Therefore, business owners must track and manage their profits effectively in order to benefit from distributions come tax time. Avoiding Tax Issues When taking out S-Corp draws, ensure that you are taking out actual profits, not loan money, such as that from the SBA. This can have significant tax implications that can lead to complications and hassles down the road. Overall, S-Corp distributions and draws are not taxable. This makes S-Corps a great choice for small business owners looking to maximize their profits and save on taxes. Just make sure you stay up-to-date on the IRS guidelines, pay yourself a fair wage first, and ensure your distributions and draws are based on profits. This can help you make informed and smart financial decisions that benefits both you and your business long-term. -

With a new year upon us, this is a time for businesses to reflect on their financial strategies and make resolutions for the year ahead that contribute to the long-term success of their organization. By adopting sound financial practices, businesses can better navigate challenges, improve their efficiency and workflows, and pave a path towards sustained growth. In this blog post, we’ll explore 10 financial resolutions that are essential for every business to make in order to have a profitable, prosperous year ahead. 10 Essential Financial Resolutions For Businesses #1: REGULAR FINANCIAL REVIEW Commit to regular (monthly or quarterly) reviews of financial statements. This includes income statements, balance sheets, and cash flow statements. Doing so will help you better understand the financial health of your business while providing you valuable insights into revenue trends, expenses, and overall financial stability. #2: INVEST IN TECHNOLOGY UPGRADES Invest in modern technology such as automotive diagnostic software, customer relationship management (CRM) systems, or accounting software to streamline your operations, save time, and increase efficiency. Consider tools like Tekmetric, Nifti CRM, and Quickbooks Online to enhance various aspects of your business. #3: SET ASIDE EMERGENCY FUNDS Financial stability largely depends on your ability to prepare for unforeseen circumstances and challenges. Therefore, make it one of your financial resolutions this year to build an emergency fund to cover unexpected expenses or economic downturns. This financial safety net can help your business stay afloat during tough times. #4: BENCHMARKING AND GOAL SETTING Regularly benchmark your business against industry standards and set realistic financial goals. Use these benchmarks and goals as a roadmap to guide you in making sound business decisions and tracking progress. #5: FOCUS ON CUSTOMER LOYALTY AND RETENTION Acquiring new customers is essential for business growth, but retaining existing customers is equally, if not more important to the longevity of your business. Plus, retaining existing customers is often more cost-effective. Develop strategies to enhance customer loyalty, such as implementing a rewards program, providing exceptional customer service, or offering regular maintenance packages. #6: OPTIMIZE INVENTORY MANAGEMENT Optimizing inventory is another key financial resolution for businesses. Aim to efficiently manage inventory to ensure that parts and supplies are available when needed, without tying up too much capital in stock. Consider implementing an inventory management system to track stock levels and optimize ordering. #7: TAX PLANNING AND COMPLIANCE Staying up-to-date on tax laws and regulations is key for your business’s financial health, especially come tax time. Work with a tax professional to develop efficient tax planning strategies and ensure compliance, thus, avoiding penalties and maximizing deductions. #8: DEBT MANAGEMENT Strategize to manage and reduce debt in the new year by prioritizing high-interest debts and looking for opportunities to refinance or consolidate loans for better terms. This can help cut down on loan payments and improve your cash flow and profitability. #9: REDUCE UNNECESSARY EXPENSES Reducing unnecessary expenses is a smart financial resolution in both your personal life and your business. Identify and eliminate unnecessary expenditures by regularly auditing expenses and finding areas where costs can be reduced without impacting the quality of your work or customer service. #10: EXPAND MARKETING EFFORTS Invest in marketing efforts to attract new customers and retain existing ones. This can include digital marketing, social media presence, local advertising, or community engagement initiatives. Tailor the marketing strategy to target the local market effectively. By making these 10 financial resolutions, your business will be well on its way to a prosperous, profitable, and streamlined future.

-

With a new year upon us, this is a time for businesses to reflect on their financial strategies and make resolutions for the year ahead that contribute to the long-term success of their organization. By adopting sound financial practices, businesses can better navigate challenges, improve their efficiency and workflows, and pave a path towards sustained growth. In this blog post, we’ll explore 10 financial resolutions that are essential for every business to make in order to have a profitable, prosperous year ahead. 10 Essential Financial Resolutions For Businesses #1: REGULAR FINANCIAL REVIEW Commit to regular (monthly or quarterly) reviews of financial statements. This includes income statements, balance sheets, and cash flow statements. Doing so will help you better understand the financial health of your business while providing you valuable insights into revenue trends, expenses, and overall financial stability. #2: INVEST IN TECHNOLOGY UPGRADES Invest in modern technology such as automotive diagnostic software, customer relationship management (CRM) systems, or accounting software to streamline your operations, save time, and increase efficiency. Consider tools like Tekmetric, Nifti CRM, and Quickbooks Online to enhance various aspects of your business. #3: SET ASIDE EMERGENCY FUNDS Financial stability largely depends on your ability to prepare for unforeseen circumstances and challenges. Therefore, make it one of your financial resolutions this year to build an emergency fund to cover unexpected expenses or economic downturns. This financial safety net can help your business stay afloat during tough times. #4: BENCHMARKING AND GOAL SETTING Regularly benchmark your business against industry standards and set realistic financial goals. Use these benchmarks and goals as a roadmap to guide you in making sound business decisions and tracking progress. #5: FOCUS ON CUSTOMER LOYALTY AND RETENTION Acquiring new customers is essential for business growth, but retaining existing customers is equally, if not more important to the longevity of your business. Plus, retaining existing customers is often more cost-effective. Develop strategies to enhance customer loyalty, such as implementing a rewards program, providing exceptional customer service, or offering regular maintenance packages. #6: OPTIMIZE INVENTORY MANAGEMENT Optimizing inventory is another key financial resolution for businesses. Aim to efficiently manage inventory to ensure that parts and supplies are available when needed, without tying up too much capital in stock. Consider implementing an inventory management system to track stock levels and optimize ordering. #7: TAX PLANNING AND COMPLIANCE Staying up-to-date on tax laws and regulations is key for your business’s financial health, especially come tax time. Work with a tax professional to develop efficient tax planning strategies and ensure compliance, thus, avoiding penalties and maximizing deductions. #8: DEBT MANAGEMENT Strategize to manage and reduce debt in the new year by prioritizing high-interest debts and looking for opportunities to refinance or consolidate loans for better terms. This can help cut down on loan payments and improve your cash flow and profitability. #9: REDUCE UNNECESSARY EXPENSES Reducing unnecessary expenses is a smart financial resolution in both your personal life and your business. Identify and eliminate unnecessary expenditures by regularly auditing expenses and finding areas where costs can be reduced without impacting the quality of your work or customer service. #10: EXPAND MARKETING EFFORTS Invest in marketing efforts to attract new customers and retain existing ones. This can include digital marketing, social media presence, local advertising, or community engagement initiatives. Tailor the marketing strategy to target the local market effectively. By making these 10 financial resolutions, your business will be well on its way to a prosperous, profitable, and streamlined future. View full article

-

With the new year quickly approaching, it can be tempting to start planning for your future goals and projects. However, it’s important to do a thorough year-end financial review before shifting your focus to the new year. This not only helps you understand the growth you’ve made and areas of learning that you can improve on, but it allows you to celebrate your accomplishments from the past year. In this blog post, we’re breaking down how to do a year-end financial review so you can plan strategically, identify opportunities for growth, and improve your financial management and health moving forward. How to Do a Year-End Financial Review Follow these simple steps and answer these guiding questions to conduct a thorough year in review for your business finances. SET THE STAGE: WHAT WERE THE FINANCIAL GOALS? To begin this process, revisit the financial goals of the business that were set at the beginning of the year. It’s important to look at factors such as revenue targets, profit margins, and expense management. These goals serve as the benchmarks that you measure your financial performance against, so reflect on how specific, measurable, and attainable these goals were. EVALUATE GOAL ACHIEVEMENT: DID WE MEET THOSE GOALS? After reflecting on the financial goals from the past year, analyze how well you performed financially against those goals. Did your business and team meet or exceed the revenue targets? Were expense controls put in place and made effective? Were there any shortfalls? If so, what reasons can you identify for those shortfalls? Celebrate the successes and growth that contributed to meeting or exceeding any financial goals. CELEBRATE SUCCESS: WHAT WENT WELL? It’s important to celebrate the financial successes and wins of the year with your entire company. Point out successful product launches, increased sales, or cost-cutting measures that proved effective for your company. Recognize the key players that made these goals a reality and provide insights into the strengths of your team’s financial strategies and operations. LEARN FROM CHALLENGES: WHAT COULD HAVE BEEN IMPROVED? Just as it’s important to celebrate your successes, it’s also important to acknowledge the challenges and areas that could have been improved. This may be budget oversights, unexpected expenses, or inefficient financial processes. By accepting and evaluating these challenges, you can make sound decisions for the future based on experience and use this as information to eliminate potential issues in the future. REFLECT ON YOUR HONEST FEELINGS Finally, put the numbers aside and reflect on your honest feelings about the past year. Where did you feel like you made the most growth? What challenged you to grow in positive ways? What caused you stress or overwhelm? What brought you the most joy and pride? How do you feel about your business currently and what are you excited for in the future? What do you want to continue in the new year and what do you need to let go to allow for other focuses? Answer these questions honestly as you wrap up your year-end financial review. It may also be beneficial to have each team member do this to learn how everyone is feeling in terms of the company and financial goals as a whole. Overall, conducting a comprehensive year-end financial review is a powerful tool for reflecting on the past, celebrating successes, learning from challenges, and making sound financial decisions for the future based on experience and data. This is about both the numbers and the feelings of you and your team. With this year in review complete, you’ll feel more confident moving into the new year with clarity!

-

With the new year quickly approaching, it can be tempting to start planning for your future goals and projects. However, it’s important to do a thorough year-end financial review before shifting your focus to the new year. This not only helps you understand the growth you’ve made and areas of learning that you can improve on, but it allows you to celebrate your accomplishments from the past year. In this blog post, we’re breaking down how to do a year-end financial review so you can plan strategically, identify opportunities for growth, and improve your financial management and health moving forward. How to Do a Year-End Financial Review Follow these simple steps and answer these guiding questions to conduct a thorough year in review for your business finances. SET THE STAGE: WHAT WERE THE FINANCIAL GOALS? To begin this process, revisit the financial goals of the business that were set at the beginning of the year. It’s important to look at factors such as revenue targets, profit margins, and expense management. These goals serve as the benchmarks that you measure your financial performance against, so reflect on how specific, measurable, and attainable these goals were. EVALUATE GOAL ACHIEVEMENT: DID WE MEET THOSE GOALS? After reflecting on the financial goals from the past year, analyze how well you performed financially against those goals. Did your business and team meet or exceed the revenue targets? Were expense controls put in place and made effective? Were there any shortfalls? If so, what reasons can you identify for those shortfalls? Celebrate the successes and growth that contributed to meeting or exceeding any financial goals. CELEBRATE SUCCESS: WHAT WENT WELL? It’s important to celebrate the financial successes and wins of the year with your entire company. Point out successful product launches, increased sales, or cost-cutting measures that proved effective for your company. Recognize the key players that made these goals a reality and provide insights into the strengths of your team’s financial strategies and operations. LEARN FROM CHALLENGES: WHAT COULD HAVE BEEN IMPROVED? Just as it’s important to celebrate your successes, it’s also important to acknowledge the challenges and areas that could have been improved. This may be budget oversights, unexpected expenses, or inefficient financial processes. By accepting and evaluating these challenges, you can make sound decisions for the future based on experience and use this as information to eliminate potential issues in the future. REFLECT ON YOUR HONEST FEELINGS Finally, put the numbers aside and reflect on your honest feelings about the past year. Where did you feel like you made the most growth? What challenged you to grow in positive ways? What caused you stress or overwhelm? What brought you the most joy and pride? How do you feel about your business currently and what are you excited for in the future? What do you want to continue in the new year and what do you need to let go to allow for other focuses? Answer these questions honestly as you wrap up your year-end financial review. It may also be beneficial to have each team member do this to learn how everyone is feeling in terms of the company and financial goals as a whole. Overall, conducting a comprehensive year-end financial review is a powerful tool for reflecting on the past, celebrating successes, learning from challenges, and making sound financial decisions for the future based on experience and data. This is about both the numbers and the feelings of you and your team. With this year in review complete, you’ll feel more confident moving into the new year with clarity! View full article

-

As the financial year draws to a close, it becomes important to have a well-organized and accurate year-end process. This ensures that you can close out the year and transition into the new fiscal year smoothly by giving attention to the key financial aspects that impact your bottom line and business as a whole. In this blog post, we’re breaking down the 7 essential steps to take to ensure a smooth financial year-end as well as sharing a Free Year-End Checklist that you can use in your own end of year review and planning. 7 Steps to Ensure a Smooth Financial Year-End STEP 1: RECONCILE ALL BANK AND CREDIT CARD ACCOUNTS The first step is to reconcile all bank and credit card accounts, as this is the foundation of a smooth financial year-end. Make sure that your records match the statements provided by the financial institutions that you work with so there are no discrepancies. By reconciling all accounts first, you can uncover potential errors and fix them quickly, maintaining the accuracy of your financial records. STEP 2: IDENTIFY AND RECTIFY DUPLICATE TRANSACTIONS If you’ve ever had duplicate transactions, you know just how much havoc they can wreak on your financial statements. This can also paint an unclear picture of your overall financial health. Thoroughly review your records to identify any duplicate transactions and rectify them quickly if you find them. Utilizing accounting software features can help you do this quickly and effectively, ensuring your financial data is accurate and reliable. STEP 3: GENERATE INCOME STATEMENT FOR THE YEAR A business’s Income Statement, also known as the Profit and Loss (P&L) Statement, summarizes the revenue, expenses, and profits or losses that a business experiences over a specific period of time. Generating a comprehensive Income Statement for the entire fiscal year provides a clear overview of your financial performance, which is a valuable tool for making decisions for the future. STEP 4: COMPILE BALANCE SHEET FOR THE YEAR A Balance Sheet is a snapshot of your company’s financial position at a specific point in time which consists of 3 main sections: assets, liabilities, and equity. It’s important to compile and review a Balance Sheet at the financial year-end to help you get a clear understanding of the overall financial health and position of your business. STEP 5: EVALUATE ASSETS Once you’ve compiled your Balance Sheet, assess the value of your assets, including both tangible and intangible assets. Make sure they are accurately valued and organized into the proper categories. When evaluating assets, don’t forget to consider the depreciation of fixed assets and any changes in the market value of investments. STEP 6: REVIEW LIABILITIES At the financial year-end, it’s also key to review any liabilities you’re responsible for, including short-term and long-term obligations. This includes loans, outstanding bills, and accrued expenses. Ensure all liabilities are recorded accurately and present a true representation of your outstanding financial obligations. STEP 7: EXAMINE EQUITY The final step in ensuring a smooth financial year-end is to examine your equity in-depth. Equity represents the ownership interest in a business. By reviewing and analyzing equity accounts, you can take note of any changes in capital, dividends, or retained earnings. This is key for understanding the financial contributions of the business’s stakeholders. In order to have a smooth financial year-end and a solid start to the new fiscal year, it requires a systematic approach, careful consideration, and attention to detail on various elements of your overall financial picture. By following these steps, you’ll be able to get a clear picture of where you’re at, where you’ve been, and plan for where you’re going. If you’d like more support as you close out the financial year, you can grab our Free Year-End Checklist to get your bookkeeping organized for 2023 and end the year with confidence and clarity.

-

As the financial year draws to a close, it becomes important to have a well-organized and accurate year-end process. This ensures that you can close out the year and transition into the new fiscal year smoothly by giving attention to the key financial aspects that impact your bottom line and business as a whole. In this blog post, we’re breaking down the 7 essential steps to take to ensure a smooth financial year-end as well as sharing a Free Year-End Checklist that you can use in your own end of year review and planning. 7 Steps to Ensure a Smooth Financial Year-End STEP 1: RECONCILE ALL BANK AND CREDIT CARD ACCOUNTS The first step is to reconcile all bank and credit card accounts, as this is the foundation of a smooth financial year-end. Make sure that your records match the statements provided by the financial institutions that you work with so there are no discrepancies. By reconciling all accounts first, you can uncover potential errors and fix them quickly, maintaining the accuracy of your financial records. STEP 2: IDENTIFY AND RECTIFY DUPLICATE TRANSACTIONS If you’ve ever had duplicate transactions, you know just how much havoc they can wreak on your financial statements. This can also paint an unclear picture of your overall financial health. Thoroughly review your records to identify any duplicate transactions and rectify them quickly if you find them. Utilizing accounting software features can help you do this quickly and effectively, ensuring your financial data is accurate and reliable. STEP 3: GENERATE INCOME STATEMENT FOR THE YEAR A business’s Income Statement, also known as the Profit and Loss (P&L) Statement, summarizes the revenue, expenses, and profits or losses that a business experiences over a specific period of time. Generating a comprehensive Income Statement for the entire fiscal year provides a clear overview of your financial performance, which is a valuable tool for making decisions for the future. STEP 4: COMPILE BALANCE SHEET FOR THE YEAR A Balance Sheet is a snapshot of your company’s financial position at a specific point in time which consists of 3 main sections: assets, liabilities, and equity. It’s important to compile and review a Balance Sheet at the financial year-end to help you get a clear understanding of the overall financial health and position of your business. STEP 5: EVALUATE ASSETS Once you’ve compiled your Balance Sheet, assess the value of your assets, including both tangible and intangible assets. Make sure they are accurately valued and organized into the proper categories. When evaluating assets, don’t forget to consider the depreciation of fixed assets and any changes in the market value of investments. STEP 6: REVIEW LIABILITIES At the financial year-end, it’s also key to review any liabilities you’re responsible for, including short-term and long-term obligations. This includes loans, outstanding bills, and accrued expenses. Ensure all liabilities are recorded accurately and present a true representation of your outstanding financial obligations. STEP 7: EXAMINE EQUITY The final step in ensuring a smooth financial year-end is to examine your equity in-depth. Equity represents the ownership interest in a business. By reviewing and analyzing equity accounts, you can take note of any changes in capital, dividends, or retained earnings. This is key for understanding the financial contributions of the business’s stakeholders. In order to have a smooth financial year-end and a solid start to the new fiscal year, it requires a systematic approach, careful consideration, and attention to detail on various elements of your overall financial picture. By following these steps, you’ll be able to get a clear picture of where you’re at, where you’ve been, and plan for where you’re going. If you’d like more support as you close out the financial year, you can grab our Free Year-End Checklist to get your bookkeeping organized for 2023 and end the year with confidence and clarity. View full article

-

Can you believe that another year is drawing close to the end? It really does seem like the older you get, the faster time goes! As we enter into the Thanksgiving season, we wanted to take some time to reflect on our achievements, the achievements of our clients, and express sincere gratitude for all of those who have made this year’s success possible. Read on for some of our thankful reflections as we celebrate financial wins from this year. Celebrating A Year of Financial Growth We’ve had the privilege of witnessing several auto shops see significant financial improvements over the course of this year. On average, clients who have been working with us for at least 1 year have seen an average revenue increase of 10.7%. That’s amazing! These financial wins are a testament to their hard work, dedication, and commitment to excellence. Our clients’ successes are our victories, so it is incredible to be able to celebrate these wins together. How Our Clients Are Seeing Success So, what exactly have our successful clients been doing to see these improvements in their business finances? Let’s take a closer look at the strategies and systems that have helped drive their financial growth. PARTS MATRICES Effective parts matrices are key for accurate pricing and inventory management. Our clients are taking advantage of this tool to optimize their pricing strategies, which directly impacts positive revenue growth. TRACKING LABOR EFFICIENCIES An auto shop’s bottom line is greatly impacted by its labor department, which is why tracking labor efficiencies is helping our clients increase profitability and identify areas for improvement. IMPLEMENTING NEW PAY STRUCTURES Our successful clients are also implementing new pay structures that work for the culture of their business, whether that is flat rate, hourly, salary, or a combo. INVESTING IN TRAINING PROGRAMS Investing in training programs for both techs and service advisors is key to the growth and development of their teams. These training programs have helped them elevate their skills and knowledge of their staff while increasing customer satisfaction and repeat customers. HIRING BUSINESS COACHES Many of our clients have also invested in industry-specific business coaches to help guide their companies towards success. Their guidance, insights, and external perspective has been a game-changer for their businesses. TRACKING KEY KPIS Lastly, many of our clients who are celebrating financial wins this year attribute their success to the tracking of key KPIs. Tracking and analyzing these KPIs has helped them make data-driven decisions for their businesses and adjust as necessary in the areas that needed more attention. Thankful Reflections From Three Rivers Bookkeeping To all the auto shops that we have the privilege of working with each and every day, we want to thank you and express our sincerest gratitude to you. Our primary goal is to see each of our clients grow and thrive. This year has been full of many financial wins, and we are honored to celebrate them alongside you. Your success is our success, and we are so thankful for the trust you have shown us.

-

Can you believe that another year is drawing close to the end? It really does seem like the older you get, the faster time goes! As we enter into the Thanksgiving season, we wanted to take some time to reflect on our achievements, the achievements of our clients, and express sincere gratitude for all of those who have made this year’s success possible. Read on for some of our thankful reflections as we celebrate financial wins from this year. Celebrating A Year of Financial Growth We’ve had the privilege of witnessing several auto shops see significant financial improvements over the course of this year. On average, clients who have been working with us for at least 1 year have seen an average revenue increase of 10.7%. That’s amazing! These financial wins are a testament to their hard work, dedication, and commitment to excellence. Our clients’ successes are our victories, so it is incredible to be able to celebrate these wins together. How Our Clients Are Seeing Success So, what exactly have our successful clients been doing to see these improvements in their business finances? Let’s take a closer look at the strategies and systems that have helped drive their financial growth. PARTS MATRICES Effective parts matrices are key for accurate pricing and inventory management. Our clients are taking advantage of this tool to optimize their pricing strategies, which directly impacts positive revenue growth. TRACKING LABOR EFFICIENCIES An auto shop’s bottom line is greatly impacted by its labor department, which is why tracking labor efficiencies is helping our clients increase profitability and identify areas for improvement. IMPLEMENTING NEW PAY STRUCTURES Our successful clients are also implementing new pay structures that work for the culture of their business, whether that is flat rate, hourly, salary, or a combo. INVESTING IN TRAINING PROGRAMS Investing in training programs for both techs and service advisors is key to the growth and development of their teams. These training programs have helped them elevate their skills and knowledge of their staff while increasing customer satisfaction and repeat customers. HIRING BUSINESS COACHES Many of our clients have also invested in industry-specific business coaches to help guide their companies towards success. Their guidance, insights, and external perspective has been a game-changer for their businesses. TRACKING KEY KPIS Lastly, many of our clients who are celebrating financial wins this year attribute their success to the tracking of key KPIs. Tracking and analyzing these KPIs has helped them make data-driven decisions for their businesses and adjust as necessary in the areas that needed more attention. Thankful Reflections From Three Rivers Bookkeeping To all the auto shops that we have the privilege of working with each and every day, we want to thank you and express our sincerest gratitude to you. Our primary goal is to see each of our clients grow and thrive. This year has been full of many financial wins, and we are honored to celebrate them alongside you. Your success is our success, and we are so thankful for the trust you have shown us. View full article

-

A key aspect of managing any business is keeping accurate financial records. One of the most important tools you can use to ensure your financial data is well-structured and organized is a Chart of Accounts. When implemented correctly, a Chart of Accounts can significantly reduce the risk of transaction classification errors, which can be detrimental to your financial reporting. This makes it easier to track income, expenses, and assets. In this blog post, we’re breaking down what a Chart of Accounts is, why it’s important, and providing a few practical tips on how to set up a Chart of Accounts in your business. What Is a Chart of Accounts? Before we get into the nitty gritty of setting up a Chart of Accounts, it’s important that you understand what it is and what purpose it serves in your business’s financials. A Chart of Accounts is a comprehensive index of all the financial accounts used by a business to classify financial transactions. These accounts are categorized into different groups and subgroups, which makes recording, tracking, and reporting on financial activities much easier. WHAT IS THE PURPOSE OF A CHART OF ACCOUNTS? A Chart of Accounts serves many purposes, including organizing finances into different categories to allow interested parties to get a clear view and understanding of a business’s financial health. It also allows stakeholders to quickly locate specific accounts in order to see which transactions are occurring in each account from the general ledger. A well-organized Chart of Accounts is also helpful for comparing financial data from year-to-year. How to Set Up a Chart of Accounts When setting up a Chart of Accounts, there are a few things to keep in mind that will help you reduce transaction classification errors. A common mistake businesses make when setting up a Chart of Accounts is having too many categories and overcomplicating the entire system. CHOOSE SIMPLE CATEGORIES We recommend that you choose simple categories that are easy to remember, such as labor income, parts income, truck fuel, insurance, etc. The more simplified and easy it is to remember these categories, the less likely it is that you or your team will make transaction misclassification errors. Plus, this also helps streamline your bookkeeping process. UTILIZE CHART OF ACCOUNTS TEMPLATES Most accounting softwares come equipped with sample Chart of Accounts templates that you can use and customize to meet your specific needs depending on your industry. This gives you a solid starting point to build upon. By utilizing these templates, you can ensure the most key categories and data points are included, which will also help reduce the risk of misclassification errors or missing data altogether. Just make sure that you review the template and tailor it to match your business’s specific needs. Remove any accounts that don’t apply to your business and add accounts that are unique to your industry or company. AUTO INDUSTRY CHART OF ACCOUNTS If you are operating in the auto industry, you’ll need a specialized Chart of Accounts designed to meet the unique accounting needs of your automotive business. This automotive-specific Chart of Accounts can help you save time, effort, and frustration, as it is tailored to the unique categories, transactions, and financial data you deal with on a daily basis. If you’re looking to improve your financial data and reporting processes, implementing a well-structured Chart of Accounts is one of the first steps we recommend that you take. It will help you streamline your accounting and bookkeeping processes and gain better control over your financial data. Follow the steps in this blog post to set your Chart of Accounts up in a way that minimizes transaction misclassification mistakes and streamlines your financial reporting.

-

A key aspect of managing any business is keeping accurate financial records. One of the most important tools you can use to ensure your financial data is well-structured and organized is a Chart of Accounts. When implemented correctly, a Chart of Accounts can significantly reduce the risk of transaction classification errors, which can be detrimental to your financial reporting. This makes it easier to track income, expenses, and assets. In this blog post, we’re breaking down what a Chart of Accounts is, why it’s important, and providing a few practical tips on how to set up a Chart of Accounts in your business. What Is a Chart of Accounts? Before we get into the nitty gritty of setting up a Chart of Accounts, it’s important that you understand what it is and what purpose it serves in your business’s financials. A Chart of Accounts is a comprehensive index of all the financial accounts used by a business to classify financial transactions. These accounts are categorized into different groups and subgroups, which makes recording, tracking, and reporting on financial activities much easier. WHAT IS THE PURPOSE OF A CHART OF ACCOUNTS? A Chart of Accounts serves many purposes, including organizing finances into different categories to allow interested parties to get a clear view and understanding of a business’s financial health. It also allows stakeholders to quickly locate specific accounts in order to see which transactions are occurring in each account from the general ledger. A well-organized Chart of Accounts is also helpful for comparing financial data from year-to-year. How to Set Up a Chart of Accounts When setting up a Chart of Accounts, there are a few things to keep in mind that will help you reduce transaction classification errors. A common mistake businesses make when setting up a Chart of Accounts is having too many categories and overcomplicating the entire system. CHOOSE SIMPLE CATEGORIES We recommend that you choose simple categories that are easy to remember, such as labor income, parts income, truck fuel, insurance, etc. The more simplified and easy it is to remember these categories, the less likely it is that you or your team will make transaction misclassification errors. Plus, this also helps streamline your bookkeeping process. UTILIZE CHART OF ACCOUNTS TEMPLATES Most accounting softwares come equipped with sample Chart of Accounts templates that you can use and customize to meet your specific needs depending on your industry. This gives you a solid starting point to build upon. By utilizing these templates, you can ensure the most key categories and data points are included, which will also help reduce the risk of misclassification errors or missing data altogether. Just make sure that you review the template and tailor it to match your business’s specific needs. Remove any accounts that don’t apply to your business and add accounts that are unique to your industry or company. AUTO INDUSTRY CHART OF ACCOUNTS If you are operating in the auto industry, you’ll need a specialized Chart of Accounts designed to meet the unique accounting needs of your automotive business. This automotive-specific Chart of Accounts can help you save time, effort, and frustration, as it is tailored to the unique categories, transactions, and financial data you deal with on a daily basis. If you’re looking to improve your financial data and reporting processes, implementing a well-structured Chart of Accounts is one of the first steps we recommend that you take. It will help you streamline your accounting and bookkeeping processes and gain better control over your financial data. Follow the steps in this blog post to set your Chart of Accounts up in a way that minimizes transaction misclassification mistakes and streamlines your financial reporting. View full article

-

How To Setup A Products and Services List For Auto Shops

nptrb posted a article in Automotive Industry

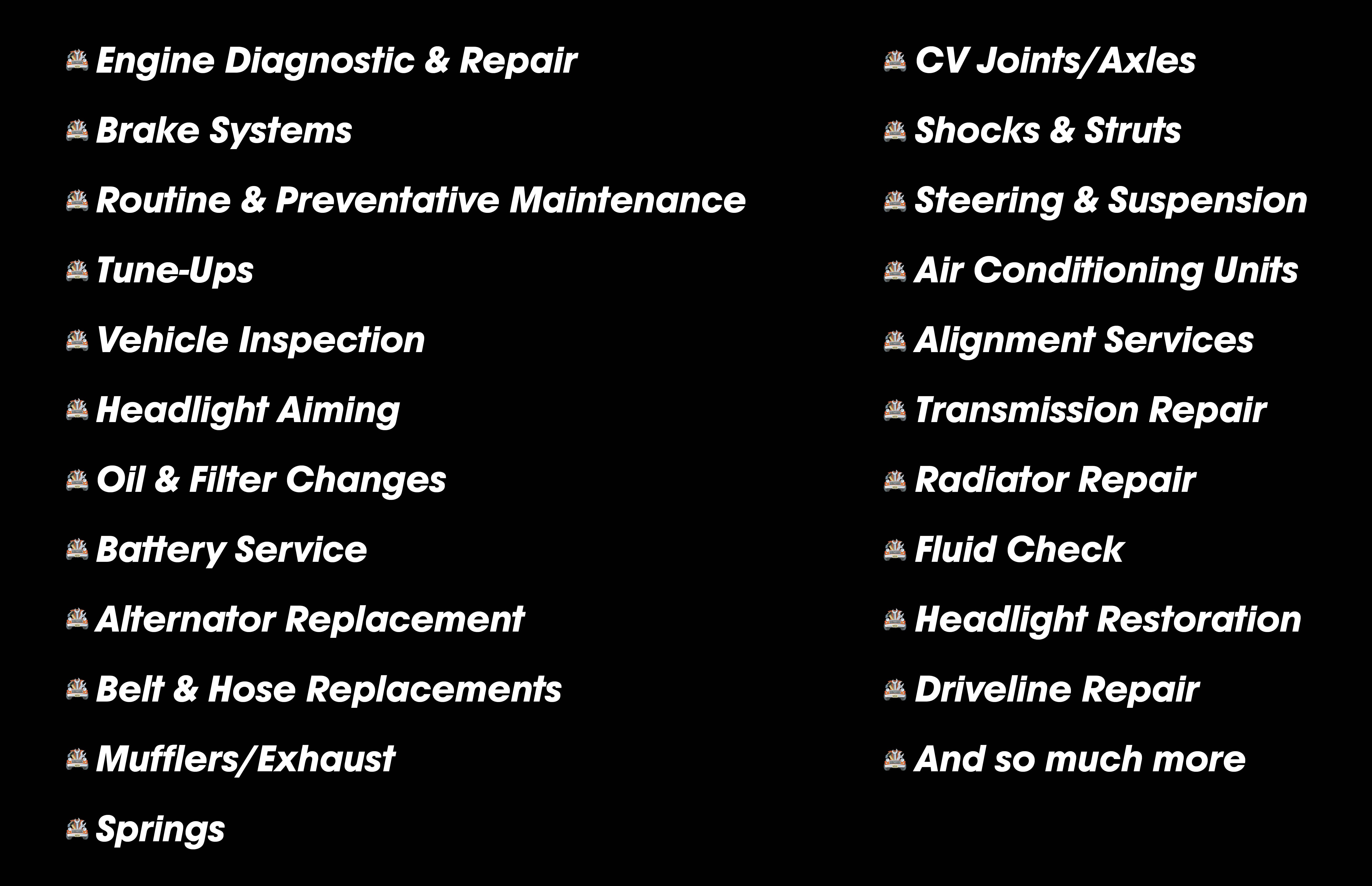

Effectively managing your products and services list is essential for auto shops. Not only does this simplify and streamline your invoicing process, but it also ensures that your financial records are accurate and organized. In this blog post, we’re breaking down a simple and practical approach to setting up a products and services list for auto shops that maximizes your overall efficiency. The Common Pitfall of Auto Shop Products and Services Lists In our work with auto shops, we often see a common pitfall in their products and services lists. The mistake they make is creating an overly extensive and long products and services list. This happens when auto shop owners add a new product or service to their list each time they make a sale. This leads to a confusing list that’s a million miles long. However, you can avoid this pitfall by streamlining your products and services and using descriptions effectively. How to Streamline Your Products and Services List Instead of creating a new product or service for each transaction in your auto shop, consider setting up a small handful of products and services and use the description to enter specific part numbers or details on the service provided. For example, set up a “Parts Service” item which is linked to the “Parts Income” on the chart of accounts. Then, each time a parts sale is made on an invoice, put the part number in the description with the correct price. Here are a few key categories that we recommend you include on your products and services list. LABOR This category covers all labor charges for various types of automotive work, such as diagnostic labor, repair labor, or maintenance labor. PARTS This is the category where it’s important to create a “Parts Service” item linked to the “Parts Income” account on your chart of accounts to avoid a long and confusing parts and services list. Whenever a part is sold, enter the part number and details in the description along with the current price. DISCOUNTS/REFUNDS This category can be used to track any discounts or refunds that are offered to customers. This is important to track separately in order to make adjustments as needed. SUBLET If your auto shop occasionally subcontracts out work to other service providers, this is the category you’ll use to record the costs of these sublet services. TIRE Having a specific tire category for tire sales, installation, and other related services is a great way to keep these invoices separate. By having a streamlined products and services list, you can ensure your list is easy to navigate, which saves you time and reduces the risk of errors. You’ll also make financial reporting more accurate by using descriptions and properly documenting each transaction. Plus, it will make invoicing and filing receipts more efficient and give you financial clarity to help you make informed business decisions.-

- services

- services offered

-

(and 1 more)

Tagged with:

-

Effectively managing your products and services list is essential for auto shops. Not only does this simplify and streamline your invoicing process, but it also ensures that your financial records are accurate and organized. In this blog post, we’re breaking down a simple and practical approach to setting up a products and services list for auto shops that maximizes your overall efficiency. The Common Pitfall of Auto Shop Products and Services Lists In our work with auto shops, we often see a common pitfall in their products and services lists. The mistake they make is creating an overly extensive and long products and services list. This happens when auto shop owners add a new product or service to their list each time they make a sale. This leads to a confusing list that’s a million miles long. However, you can avoid this pitfall by streamlining your products and services and using descriptions effectively. How to Streamline Your Products and Services List Instead of creating a new product or service for each transaction in your auto shop, consider setting up a small handful of products and services and use the description to enter specific part numbers or details on the service provided. For example, set up a “Parts Service” item which is linked to the “Parts Income” on the chart of accounts. Then, each time a parts sale is made on an invoice, put the part number in the description with the correct price. Here are a few key categories that we recommend you include on your products and services list. LABOR This category covers all labor charges for various types of automotive work, such as diagnostic labor, repair labor, or maintenance labor. PARTS This is the category where it’s important to create a “Parts Service” item linked to the “Parts Income” account on your chart of accounts to avoid a long and confusing parts and services list. Whenever a part is sold, enter the part number and details in the description along with the current price. DISCOUNTS/REFUNDS This category can be used to track any discounts or refunds that are offered to customers. This is important to track separately in order to make adjustments as needed. SUBLET If your auto shop occasionally subcontracts out work to other service providers, this is the category you’ll use to record the costs of these sublet services. TIRE Having a specific tire category for tire sales, installation, and other related services is a great way to keep these invoices separate. By having a streamlined products and services list, you can ensure your list is easy to navigate, which saves you time and reduces the risk of errors. You’ll also make financial reporting more accurate by using descriptions and properly documenting each transaction. Plus, it will make invoicing and filing receipts more efficient and give you financial clarity to help you make informed business decisions. View full article

-

- 2

-

-

- services

- services offered

-

(and 1 more)

Tagged with:

-

Taxes are an unavoidable part of life, and for many individuals and businesses, it can be an overwhelming process and stressful financial burden. We often dread those spring months when tax season is in full swing and we’re rushing to gather the appropriate documents, financial statements, receipts, and more for tax planning and filing. However, by planning for taxes ahead of time throughout the year, you can reduce your tax liability and ensure you are well-prepared for tax season. Plus, you won’t feel so rushed and stressed come tax crunch time. Read on for a few tax planning tips that can help you get ahead on your taxes and make the entire process smoother and less stressful. Tax Planning Tips TIP #1: KNOW WHAT YOUR TAXES ARE BEFORE ASKING IF YOU NEED TO REDUCE THEM. When planning for taxes, it’s important to have a clear understanding of what your taxes are. This will help you effectively reduce your tax liability. In order to do this, you must know your income, expenses, deductions, and credits. Take the time to thoroughly review your financial records and calculate your tax liability accurately. This is a foundational first step to help you start your tax planning efforts with the most accurate information. TIP #2: PLAN FOR TAXES THROUGHOUT THE YEAR. The next tax planning tip is to plan and prepare for taxes throughout the year, not just once a year during the busy tax season. This is a common mistake that many people make. Then, they often find themselves in a rush, making errors, and struggling to get support from accountants who are already booked out with tax work. Tax planning should be an ongoing process that you do throughout the entire year. Review your financial situation and make adjustments regularly. This will help you avoid last-minute stress, feel more prepared, and can even lead to opportunities for tax savings. TIP #3: IMPLEMENT A 3 PHASE TAX PLANNING APPROACH. To help you plan for taxes throughout the year, implement a 3 phase tax planning approach. Here’s a breakdown of what each phase might look like. PHASE 1: WHILE PREPARING THE TAX RETURN FOR THE PREVIOUS YEAR. Begin the first phase of the tax planning process by reviewing the previous year’s tax return. Look at what your financial picture and overall financial health looked like. Ask yourself if there were any significant changes in your income and/or expenses. Check to see if this year’s trends are in line with last year’s. Take note of any projected financial growth or slowdowns, as this will inform your tax planning decisions. PHASE 2: END OF JUNE Around the end of June, take another look at your financials thus far for the year. This is a great time to get a solid estimate of where you’re at and what the rest of the year will look like. If you’ve experienced good growth so far, you may want to consider increasing your estimated tax payments to avoid penalties and interest. This also gives you time to prepare for higher taxes in the spring by saving more for taxes. This is also an ideal phase to assess if there have been any major gains or losses in your income or business investments, as these may require you to adjust your tax planning strategy. PHASE 3: OCTOBER OR NOVEMBER As the year progresses, continue to monitor your financial situation and take a look in October or November to see if any new opportunities for tax planning have emerged. This is the time when you may consider making significant purchases before the end of the year that will benefit your tax situation. By implementing these 3 simple tax planning tips throughout the year, you can set yourself up for a less stressful (and surprising) tax return. You’ll head into tax season feeling confident in your decisions and prepared for any tax liability you must take care of. It’s important to remember that tax laws and regulations can change, so be sure to stay informed and consult with an accountant or tax professional to stay up-to-date.

-

In the world of business, cash flow management is a key element of financial success. A business’s ability to effectively manage the cash coming in and out of the business will ultimately determine whether it remains successful and profitable or struggles to keep its doors open. One of the most widely used strategies for cash flow management comes from the book Profit First by Mike Michalowicz. This strategy helps business owners transform the way they manage their finances in order to ensure stability, growth, and confidence knowing they’ll always get paid. Read on to learn more about this strategy and how it can help you master cash management in your business. What Is the Strategy for Cash Management? The Profit First strategy that Mike Michalowicz teaches is more than just a financial concept. It’s a true mindset shift around how you manage your money and operate your business. This mindset prioritizes profitability over everything else. In fact, it’s so powerful that the Profit First method has been copyrighted, as it is so well known for helping business owners transform the way they look at and manage their finances and make decisions. The core principle of the Profit First strategy is to set aside an allotted percentage of revenue as profit to pay yourself first before you pay off any expenses or set money aside for taxes. Instead of the traditional profit formula of Sales - Expenses = Profit, this strategy flips the equation, making it Sales - Profit = Expenses. It might seem like a small, simple shift, but it can have a huge impact on your business’s overall financial health and the health of your personal finances as a business owner. The Power Of Separate Accounts One of the key ideas behind the Profit First strategy is to have separate bank accounts for different aspects of your business in order to manage cash flow and divide money appropriately. This is the bread and butter of the strategy and is where you’ll see the most positive impact on your cash flow management. By separating out your accounts, you’ll be able to see exactly what’s going in and out of each account, allowing you to make sound financial decisions and take control of your business finances. The two most important accounts to have are taxes and payroll. How this works is the business owner transfers a certain percentage of revenue into these separate checking accounts, and payroll and taxes are then paid from their specific accounts. By having these separate accounts, you can ensure that you are consistently saving money for taxes so you never have to scramble at the last minute to scrape together enough money to cover your tax obligations. Your employees are the heartbeat of your business, so it’s essential to set aside funds in a payroll account to ensure you can always pay them on time. Benefits of The Profit First Strategy There are many benefits of using the Profit First strategy for your cash management. First, by having separate bank accounts for each aspect of your accounting, it creates clarity in your finances, allowing you to see where your money is going, which makes it easier to make informed decisions based on the numbers. It also can greatly reduce the stress on the business (and owner) by knowing that you always have funds set aside to pay your taxes and your employees. With this strategy, you never have to worry about your obligations come tax time or pay day. With the focus on profit, your business will increase profitability and be able to grow sustainably. Your spending will be under control and you’ll be able to make sound business decisions that drive you towards growth. Plus, in all of this, you’ll actually be able to pay yourself! So often, business owners put paying themselves on the backburner, especially in tough times. With the Profit First strategy, paying yourself a wage before expenses or taxes is a priority. If you’re looking to implement the Profit First strategy in your business to increase cash flow, I highly recommend getting a copy of Mike Michalowicz’s Profit First book. It teaches the tried and true, straightforward process for putting this strategy in action.

-

As an auto shop owner, one of the most important aspects of managing your business and ensuring it is profitable is effectively organizing and analyzing financial statements in order to make sound decisions for your shop and employees. As an accountant for auto shop owners, I often see financial statement issues arise that cause frustration, overwhelm, and discrepancies in a shop’s finances. In this blog post, I’m breaking down 6 of the most common issues with auto shop financial statements and offering quick tips on how to fix them. Financial Statement Issues In Auto Shops Not Understanding Your Financials The first issue I see with financial statements is auto shop owners simply not understanding their financial statements. They don’t know what they’re looking at, what the numbers mean, or how to navigate QuickBooks. This can make it really hard to make sound financial decisions if you don’t know how to use them to increase profits and make sound financial decisions. Solution: The solution to this issue is to set your financial statements up in a way that you can easily access, organize, and understand them. We recommend using QuickBooks for all of your financial statements, as this makes it easy to organize and analyze them. Shop Management Software Doesn’t Match QuickBooks The next common financial statement issue is having discrepancies between your Shop Management System (SMS) and your accounting software, such as QuickBooks. This can lead to a lot of confusion and inaccurate financial reporting. Your SMS may offer one figure, but what QuickBooks shows is the most accurate financial recording. Solution: The solution to this issue is to make being consistent in your financial reporting a priority. Calculate and record your financial data in the same way each month, at the same time of the month. Err on the side of being conservative with your figures to ensure your shop remains profitable and your financial statements reflect the actual performance of your shop as accurately as possible. Parts and Labor Income Are Not Split Out Failing to keep parts and labor income separate in your financial statements is another big issue, which makes it difficult to see where your actual revenue is coming from. With labor, there are so many factors to consider, such as employee wages, paid time off, benefits, etc, so it’s important to keep these aspects separate. Solution: The solution for this financial statement issue is to organize your income into separate categories for parts and labor. This will give you clarity in your finances and make it easier to analyze how profitable each aspect of your business is. This will help you make more informed decisions for your business. Parts and Labor Cost Of Goods Sold Are Not Split Out Similar to the last problem, if you fail to split out parts and labor costs of goods sold, you can create discrepancies in your gross profit margin. This is a key indicator of the overall financial health of your business, so it’s important that it is as accurate as possible. It’s important to note that technician pay should be classified as a labor cost of goods sold for the most accurate financial reporting. Solution: When setting up your accounting software, make sure to create a clear separation between parts and labor costs of goods sold. This will help you see the profitability of each side of your auto shop, allowing you to lean into the revenue streams that bring in the most money for your shop. Be sure to classify technician pay as a labor cost of goods sold. Not Tracking Warranty Work Warranty work is where a lot of financial statement issues arise. When you are looking at your financial statements, you must account for warranty work, otherwise, your income will look skewed as well as your expenses. Solution: To ensure warranty work is classified and tracked properly, create a simple system to track this work and any transactions related to warranties. This will keep your financial statements accurate. Misclassifying Transactions The last common financial statement issue in auto shops is misclassifying transactions. When you set up your QuickBooks, do so in a way that allows you to easily classify each transaction properly right away. This is an issue with a simple fix, but it can drastically skew your financial statements. Solution: After setting your QuickBooks up in a way that works for you to keep everything properly classified, make sure to regularly review your transactions to verify they’re accurately classified. This will help you catch any outliers or misrepresentations before it becomes a huge issue. All in all, by knowing what financial statement issues to look out for in your auto shop business, you can ensure you are set up for success and have your QuickBooks laid out in a way that works for you, that makes it easy for you to manage and understand.

-